foreign gift tax return

Tax ramifications on the initial receipt of a gift from a. For the same reason if you.

Foreign Gift Taxes What You Need To Report Greenback Expat Tax Services

The gift tax return exists to keep US.

. The tax applies whether or not the. Nonresidents are subject to the same tax rates but with exemption of 60000 for transfers at death only. Further you must report foreign gifts from foreign corporations or foreign partnerships of more than 16649 as of tax year 2020 on Form 3520.

The purpose of Form 3520 is to be an informational return that is included with your personal income tax return. Even though there are no US. Specifically the receipt of a foreign gift of.

You are able to file a joint form with your spouse if. Basically the disclosure of. Person must r eport the Gift on Form 3520.

The IRS Reporting of International Gifts is a very important piece in the Offshore Compliance puzzle. Person receives a gift from a foreign person that meets the threshold for filing the US. We speak your language.

Form 3520 is an informational return similar to a W-2 or 1099 form rather than an actual tax return because foreign gifts themselves are not subject to income tax unless they. For gifts from foreign corporations or foreign partnerships you are required to report the gifts if the gifts from all entities collectively exceed 16388 for 2019. You must individually identify.

While foreign gift tax may not be due by the donee a foreign person gift does have a disclosure requirement to the IRS if it exceeds certain thresholds. Sections 6018 a 2. A gift tax return is a tax form that needs to be filed by the donor of the gift if they make a transaction of the gift of value exceeding the prescribed limit known as gift tax exemption Tax.

Citizens accountable for their annual excludable amount of 15000 and lifetime gift and estate tax exemption of 114 million. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return. Important Practice Tip If you receive a gift.

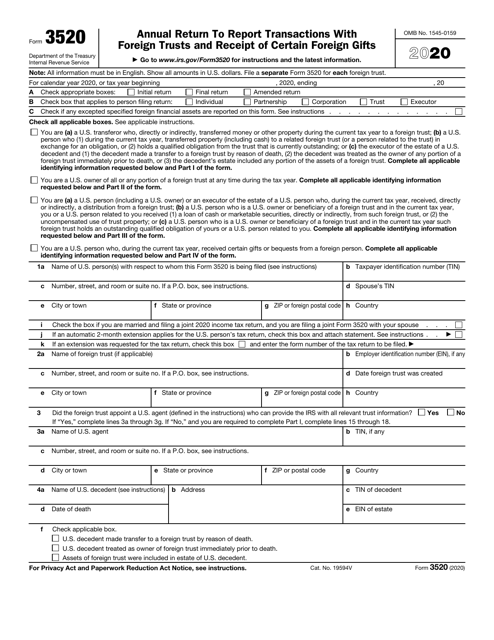

If you fall within these reporting rules you are required to file Form 3520 Annual Return to Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts The. Form 3520 is used to report the existence of a gift trust or inheritance received from foreign persons. This value is adjusted.

Below is the table for computing the gift tax.

Irs Updating Taxpayer Addresses Using Post Office S Yellow Label Info Don T Mess With Taxes

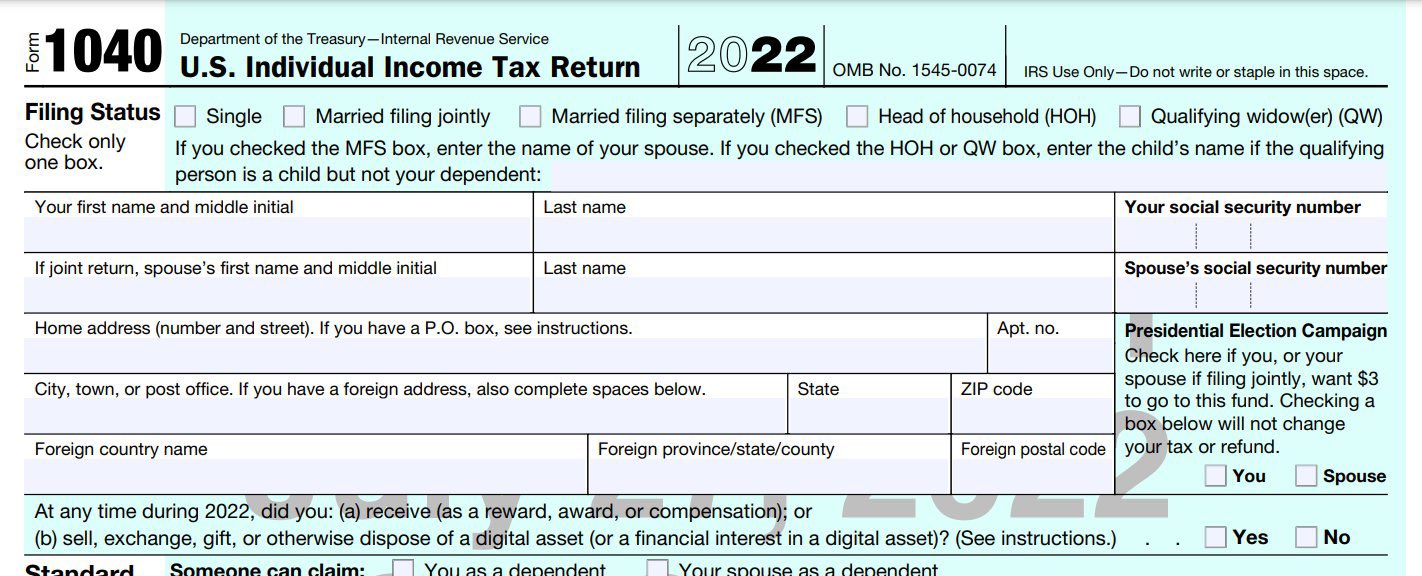

Crypto Tax Girl On Twitter The Irs Has Updated The Crypto Tax Question On The Draft 2022 Tax Form Https T Co Edyly45cas Twitter

Irs Expands Crypto Question On Draft Version Of 1040 Accounting Today

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

![]()

Irs Updates The Crypto Question On 2022 Draft Form 1040 Cointracker

Do I Have To Pay Taxes On A Gift H R Block

Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

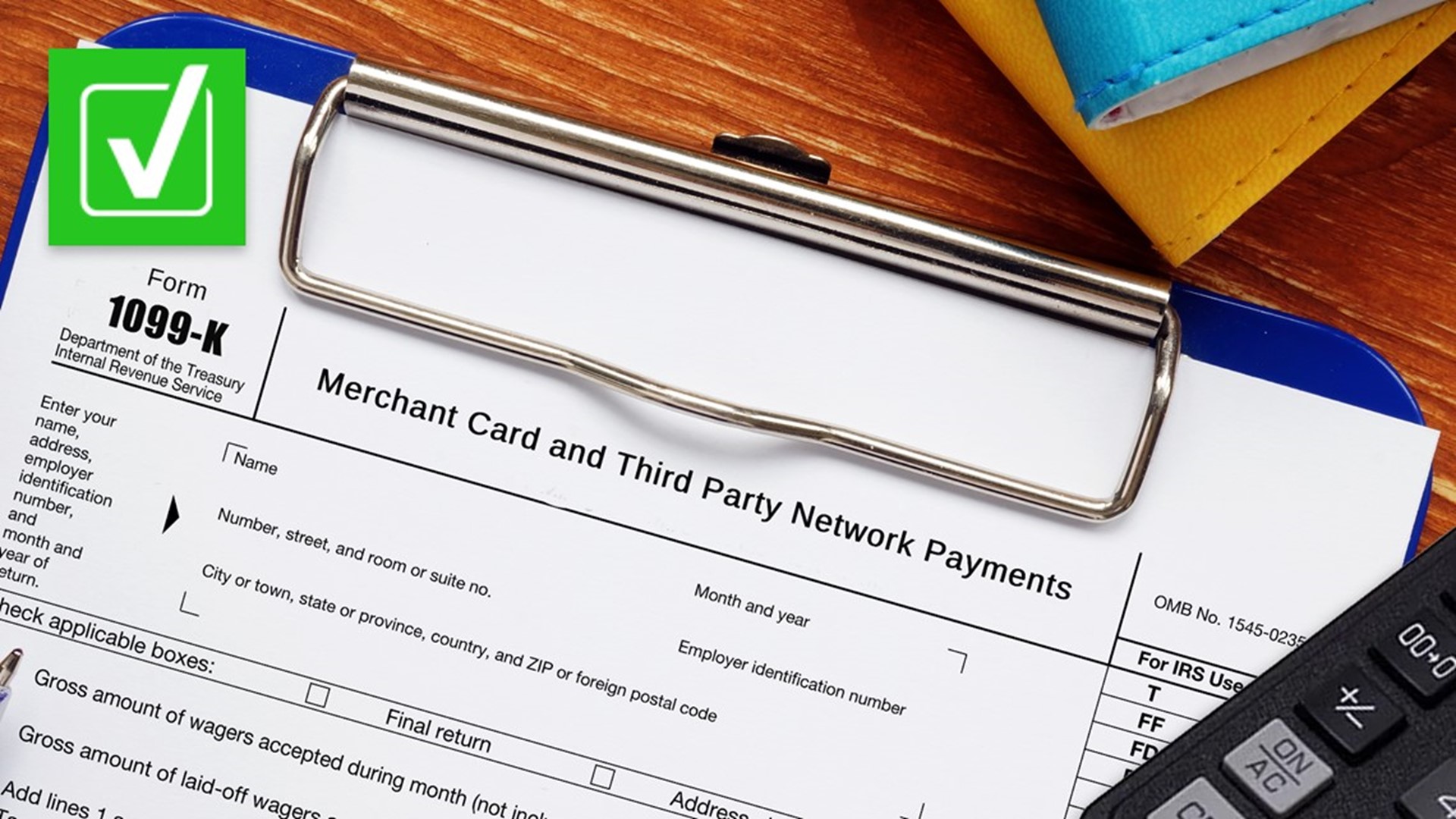

What Cash App Users Need To Know About New Tax Form Proposals Verifythis Com

Gifts From Foreign Persons New Irs Requirements 2022

Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts

2018 Oklahoma Return Of Organization Exempt From Income Tax Form Fill Out Sign Online Dochub

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

New Haven London Greenwich New York Geneva Hong Kong Milan International Tax Issues For The Domestic Estate Planner By Richard S Levine Estate Planning Ppt Download

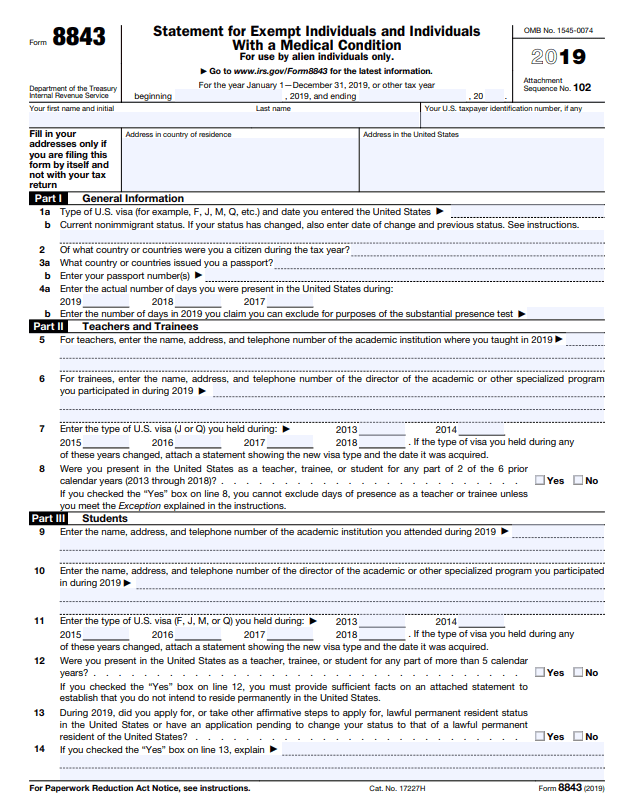

Us Tax For Nonresidents Explained What You Need To Know

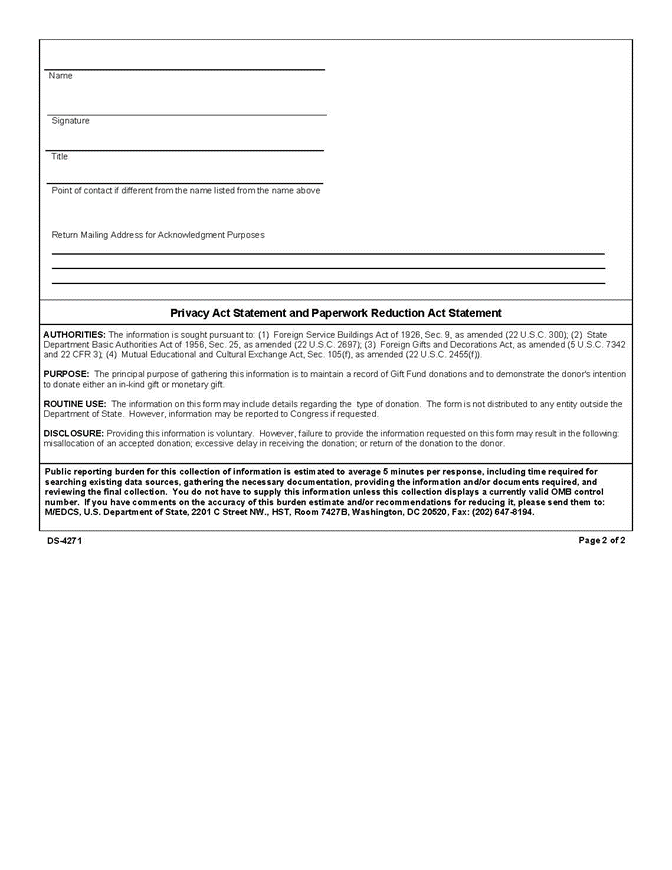

2 Fam 960 Solicitation And Or Acceptance Of Gifts By The Department Of State

Irs Form 3520 Download Fillable Pdf Or Fill Online Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts 2020 Templateroller

Foreign Gift Tax Ultimate Insider Info You Need To Know For 2022

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition